GEI Insight | Current Situation of Green Electricity Certificates

Contributed by Dr. Shengnian XU, GEI Energy and Climate Change Program Officer

In early 2017, the National Development and Reform Commission (NDRC), the Ministry of Finance and National Energy Administration issued a notice of the trial of “Green Electricity Certificates” (referred to as “GEC”).

The notice states that the voluntary trading platform for GEC would be launched in July 2017. Then, from 2018, the renewable electricity quota assessment and the constrained trade of GEC would be launched based on market subscription.

Although GEC was launched on time, the current trade situation is struggling in three main ways (all data from Subscription Trading Platform of China Green Electricity Certificate, as of March 27, 2018):

1. Those who have GEC’s are not putting them up for sale

– Of the 20.75 million GEC issued by the government, only 4.62 million have been put up for sale;

2. The rate of people buying GEC’s is very low

– Of the 4.62 million GECs up for sale, only 27,145 have been sold;

3. The disparity between wind and solar GEC sale and purchase is very large

– Of the 4.62 million GECs for sale, 4.43 million are for wind electricity and 190,000 for solar electricity);

– Of the 27,145 GECs sold, 27,019 in wind electricity and 126 in solar electricity

* the difference in wind and solar GECs sale amounts can be attributed to the fact that solar GECs are much more expensive than that of wind.

Moving forward, it will be important to monitor the quota of renewable energy and how the trade is constrained – mostly in terms of GEC trading price.

Quota

On March 23, 2018, the National Energy Administration sought comments on the Renewable Electricity Quota and Assessment (draft). Importantly, Chapter 1 Amendment 1 of the draft specified the minimum ratio of renewable electricity consumption of all provincial administrative regions. The draft also lists the total quota and non-hydroelectric quota standards for provincial administrative regions in 2018 and 2020.

What we can tell so far is that the quota is a proportion indicator of “consumption” rather than “production” and that the quota is assessed in two ways: total renewable electricity quota (referred to as total quota) and non-hydroelectric renewable electricity quota (referred to as non-hydroelectric quota).

GEI Insight on Provinces’ Renewable Energy Quota

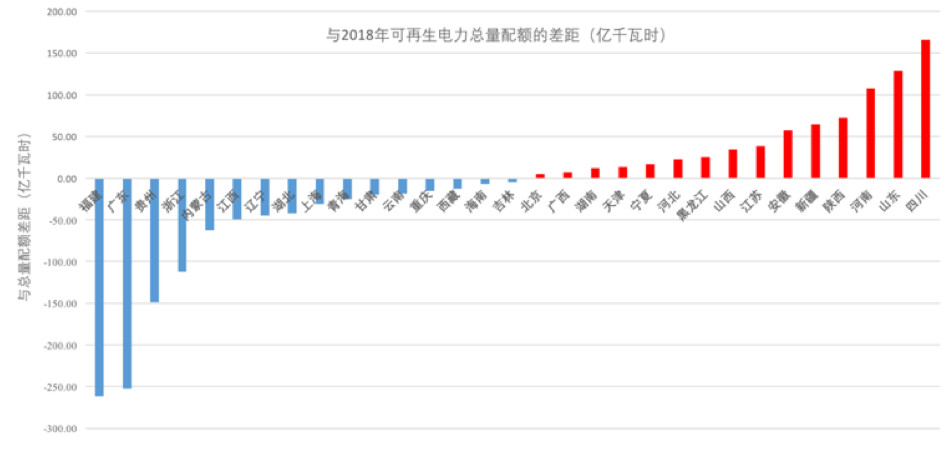

Combined with the National Renewable Electricity Development, Monitoring and Evaluation Report in 2017, GEI analyzed the annual national quota standards (draft) in 2018 based on the situation of 2016.

Our analysis (Figure 1) was able to determine which provinces and cities need to improve the ratio of renewable electricity by increasing the production of renewable electricity or purchasing enough GEC.

We also were able to analyze which provinces need to increase the proportion of non-hydroelectric quota (figure 2).

As shown in Figure 2, except for Inner Mongolia, Yunnan, Guizhou and Hainan, all provinces need to increase non-hydroelectric quota.

Furthermore, it is possible to predict that given the great imbalance between these 4 provinces and the rest of China – 10.39 billion kilowatt-hours to 115.92 billion kilowatt-hours – purchases of GEC will not be enough to fill the non-hydroelectric quota gap.

GEC Price

GEC has a huge potential for profit generation. Let’s see how:

The total demand for energy is 115.92 billion kilowatt-hours, but present, the total non-hydropower renewable electricity issued by the GEC platform is only 20.75 billion kilowatt-hours.

If 100% of the total demand was covered by GEC – that would be 115.92 million GEC – priced at 200RMB each, the expected annual turnover could about 23.2 billion RMB!

GEI Insight on Real GEC Price

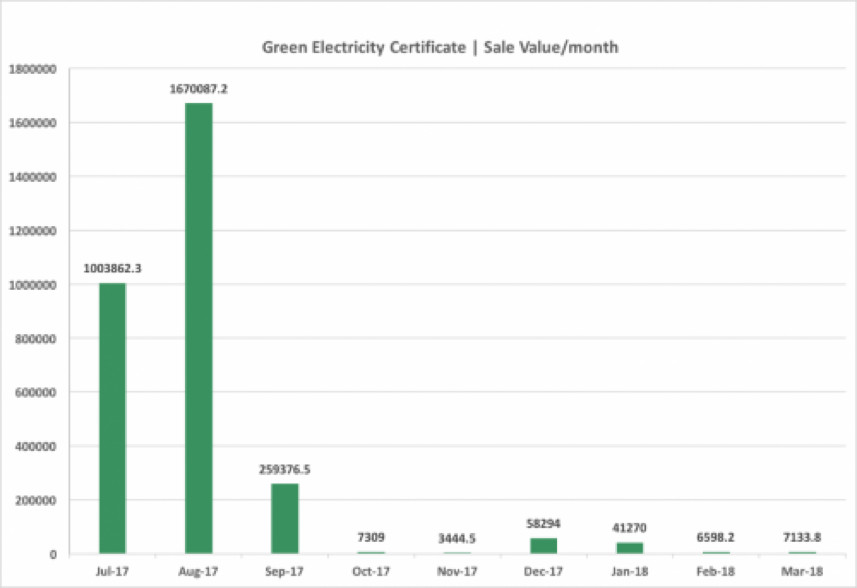

During our research, GEI experts noticed that some of the data regarding GEC sales on the official website had inconsistencies. And so, to complete our analysis, we did some of our own data mining.

We found that since July 1, 2017, of the 4.65 million GECs have been made available online, 15,942 have been sold at an average price of 191.8 RMB per certificate, therefore totaling about 3.057 million RMB. We can therefore also estimate, that given the 4.634 million unsold number of listings, the lost profitability is about 1.16 billion RMB.

To go a bit deeper, we looked at time period in which the GEC’s were purchased. Figure 3 shows that most of the transactions were concentrated in the first two months after the trading platform was launched.

We also wanted to better understand the income from GEC, in terms of if the revenue from solar or wind GEC was more significant.

According to weighted average price of GEC, solar electricity certificate is 702.8 yuan per certificate, wind electricity certificate is 219.8 yuan per certificate; but the average size of registered GEC projects for solar power is 28 MW, and for wind electricity is 62.9 MW.

Therefore, we believe that the high price of the solar GEC makes it a less attractive option, and so wind GEC transactions would comprise most of the platform activities as shown in figure 4.

NOTES

1. All the purchase records of GECs were collected through python program from Subscription Trading Platform of China Green Electricity Certificate. If you need program scripts or data, contact GEI.

http://www.greenenergy.org.cn

2. There are still some problems with the data statistics of the Green Certificate Trading Platform, for example, the number of sold GEC in the website doesn’t include the cases that a single purchase for more than 1000 GEC.

http://www.greenenergy.org.cn/gctrade/shop/product/content/41.jhtml

POINTS FOR DISCUSSION

1. According to the quota of non-hydropower electricity in 2016, most of the provinces and cities cannot meet the requirements in 2018. Our analysis also shows that the 20.75 million GEC issued so far (assuming annual issuance) may not meet the requirements either. Meanwhile, the extra quota in the rich provinces is far from enough to meet the needs of other provinces.

2. In the end of 2017, the national ETS carbon market was launched. Although the in the future carbon market and GEC market can work together and together contribute to China’s carbon emission reduction, the market policy overlap should be considered simultaneously.

REFERENCE

1. A letter from the National Energy Administration to Seek Commands on Renewable

Energy Quota and Assessment (draft): http://www.nea.gov.cn/2017-02/06/c_136035626.htm

2. Green Certificate Subscription Platform: http://www.greenenergy.org.cn/gctrade/shop/index.html

3. National Energy Administration, 2018, Renewable Electricity Quota and

Assessment (draft): http://zfxxgk.nea.gov.cn/auto87/201803/t20180323_3131.htm

4. National Energy Administration, 2018, Statement of Renewable Energy Power Quota and Assessment Method: http://zfxxgk.nea.gov.cn/auto87/201803/t20180323_3131.htm

5. National Energy Administration, 2017, National Renewable Energy Power

Development, Monitoring and Evaluation Report in 2016: http://zfxxgk.nea.gov.cn/auto87/201704/t20170418_2773.htm

6. New Clean Energy Buying Option in China: Green Electricity Certificates

http://www.wri.org/blog/2017/10/new-clean-energy-buying-option-china-green- electricity-certificates