GEI Insight|Can China Learn Lessons from the India GEC System?

This article was written by GEI intern David Wan. David has completed his internship at GEI over the summer.

This article continues our exploration of China’s Green Energy Certificate system and the factors holding back its development. In this piece we compare and contrast the Chinese system with India’s system. As a developing country also facing intense environmental challenges and growing energy demand, the complexity of becoming green in India is not dissimilar to the Chinese experience.

CHINA

About the GEC System

With the national goal of “at least 15% of primary energy consumption and 27% of all electricity generation from RE by 2020,” it is crucial for China to continue on encouraging renewable energy generation from solar and wind sources. Renewable energy’s high cost of development, however, has made government subsidies an integral part of the equation for China’s RE generators. Then, as the construction of more RE generation plants, the demand for governmental subsidies also skyrocketed.

Photo: Kevin Frayer/Getty Images

Photo: Kevin Frayer/Getty Images

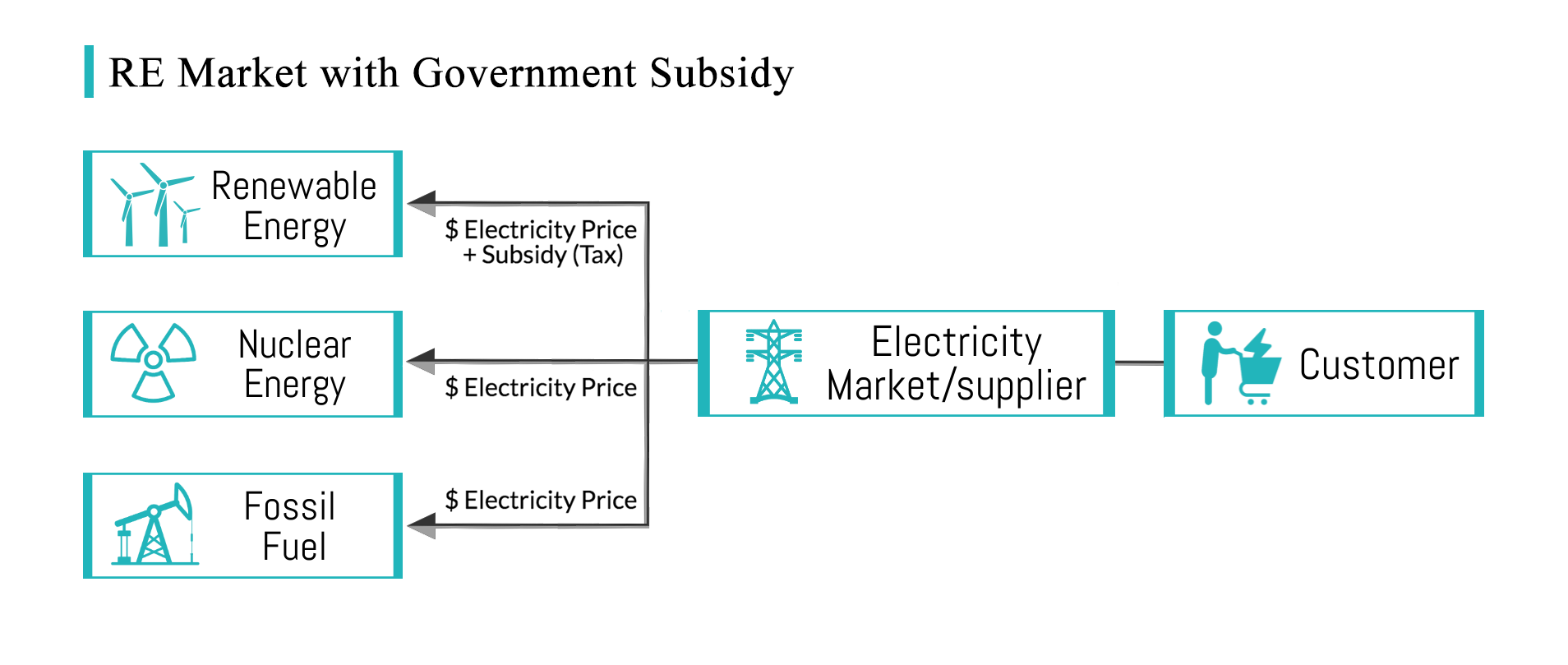

The renewable market continues to grow and so governmental aids (largely in the form of taxes) are no longer sufficient, especially in face of the growing gap of subsidy funding.

Source: GEI, 2017

Source: GEI, 2017

In July 2017, the green energy certificate (GEC) market was introduced to serve as a secondary income for the renewable energy generators. These generators are able to put the certificates for sale online and the corresponding income from the certificates will no longer require government subsidization. Finally, the remaining generation not covered by GEC will receive the original governmental subsidy. In this way, GECs enable the generators to replace or at least mitigate the increasing government subsidy.

Source: GEI, 2017

Source: GEI, 2017

Mechanism for Spurring Demand – Trading Market

In addition to the GEC market, the Chinese government launched a GEC trading system in July 2017. The trading system specifically aims to improve corporate and public responsibility for reaching national RE targets and to try to close the government’s growing subsidy funding gap.

The platform was launched with 20.75 million GEC issued by the government with 4.62 million for sale. Over the past year, only a meager 27 thousand (less than 0.5 percent) have sold. The primary reason for this low sale is low incentives – a sense of social responsibility and enhancement of overall corporate image are the only two benefits a GEC offers to a customer.

INDIA

About the REC System

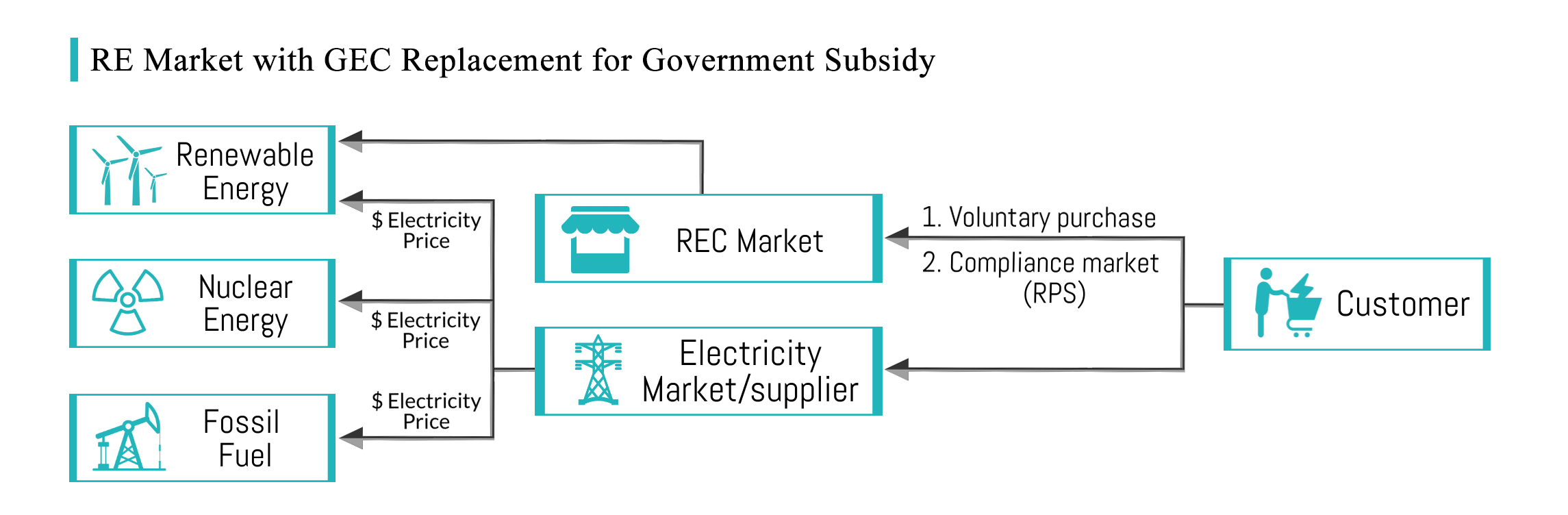

India started its renewable energy certificate (REC) program back in 2011. Unlike China, India utilizes its REC as a market-based instrument to promote renewable energy and to facilitate compliance of renewable purchase obligations (RPO). Additionally, it also aims to address the mismatch between availability of RE resources in state and the requirement of the obligated entities to meet the renewable purchase obligation (RPO).

Photo: platinumway.biz

Photo: platinumway.biz

Unlike China’s GEC system which only has solar and on-shore wind energy, India allows many more sources of RE for REC sales, including solar, wind, small hydro, biofuel, municipal waste, and any other source of RE approved by the MNRE. This vast variety of options provide more opportunities for enterprises to fulfill their RPO while also supporting small-scale renewable energy sources.

Photo: REEEP

Photo: REEEP

Mechanism for Spurring Demand – Voluntary and Required Obligations

Over the course of its development, India’s REC system has faced its own share of challenges. After India’s REC implementation in 2011, the country’s obligatory and voluntary purchase system elucidated many flaws that existed in their policies. In fact, up until mid-2017, the nation had close to 20 million unredeemed GECs. Their supply of RECs was much greater than the demand, which kept the certificate prices around the floor price.

Photo: Livemint

Photo: Livemint

In order to keep demand high for their REC system, the Indian government introduced a Renewable Purchase Obligation (RPO) to make sure that all organizations fulfill their “obligation” of purchasing REC. This RPO system has not been without its problems but has equipped the government with another tool to direct market activity.

Lessons for China?

Looking at the case of China and India, we can point out a couple interesting points of difference, that may also serve as opportunities for China.

Photo: World Economic Forum

Photo: World Economic Forum

Variety of Renewable Energy Sources

First, is the number and variety of renewable energy sources available for GEC. In fact, India allows for several different sources of renewable energy, unlike China which is limited to just two. By increasing the options for renewable energy available for GEC, it may be possible to further mitigate its current subsidy gap.

Quota System

The second point of comparison is India’s combination of voluntary and required obligations. As mentioned above, while China’s current REC platform relies on a voluntarily purchasing process, India utilizes RPO to make sure that all organizations fulfill their “Obligation” by purchasing Renewable Certificates. Introducing a required obligation could help spur demand and activity in the market, as Chinese enterprises and individuals lack a fundamental motivation to purchase and participate in the non-obligatory and non-awarding system.

Photo: Renewable Choice Energy

Photo: Renewable Choice Energy

In a recent governmental proposal, China’s energy department advocated for a quota system that targets provincial green electricity consumption. Through this system, each province/city is required to fulfill a specific amount of renewable electricity use determined by their entire consumption. For provinces/cities that are incapable of fulfilling this requirement, they are allowed to purchase RE certificates to make up for the disparity.

Recommendations for a Quota System

While a quota system that requires provinces/cities to fulfill their renewable energy obligations will certainly propel sales, it is not to say that it will function flawlessly and the reports by the Indian Energy Exchange and India’s official REC registry attest that there are occasionally issues. Therefore, there are several policies implemented by the Indian government that can be utilized by China in the future.

- Price of the Required Obligation

Setting the floor and forbearance price within the ROC is imperative for regulating company purchases. In fact, certificates typically sell at the floor price, lowest price a certificate can be sold at (vice versa for forbearance price). However, if a company fails to reach its renewable obligations, it will have to purchase certificates at the much higher forbearance price. This method effectively makes sure that companies will not attempt to evading RE goals. - Validity of the Certificate

In January 2015, the GEC lifespan validity of REC was extended from 365 to 1095 days. - Percentage of Market Share

India also introduced a method to incorporate higher percentage of Solar REC sales. By utilizing vintage multiplier and increasing the percentage of Solar RPO each year, this method can slowly weaken the current dominance of wind power REC in the market. Inspecting upon the current distribution of China’s REC, Solar only takes less than 5% of the market. The gradual increase of Solar RPO% will eventually even out the difference.

Photo: Getty Images

Photo: Getty Images

Conclusion

In the end, GEC have the potential to contribute to China’s overall sustainable development and integration of renewable energy. However, given the nascent stage of the sector’s development, there may be an argument for having more intervention to encourage market growth.

Reference:

“Renewable Energy Certificate Registry of INDIA.” Renewable Energy Certificate Registry of INDIA, 2018, recregistryindia.nic.in/.

Awasthy, Akhilesh. REC Market in India Issues and Prospects. Indian Energy Exchange, 2014,REC Market in India Issues and Prospects.

可再生能源发展“十三五”规划(公开发布版),国家发展改革委,2016年12月